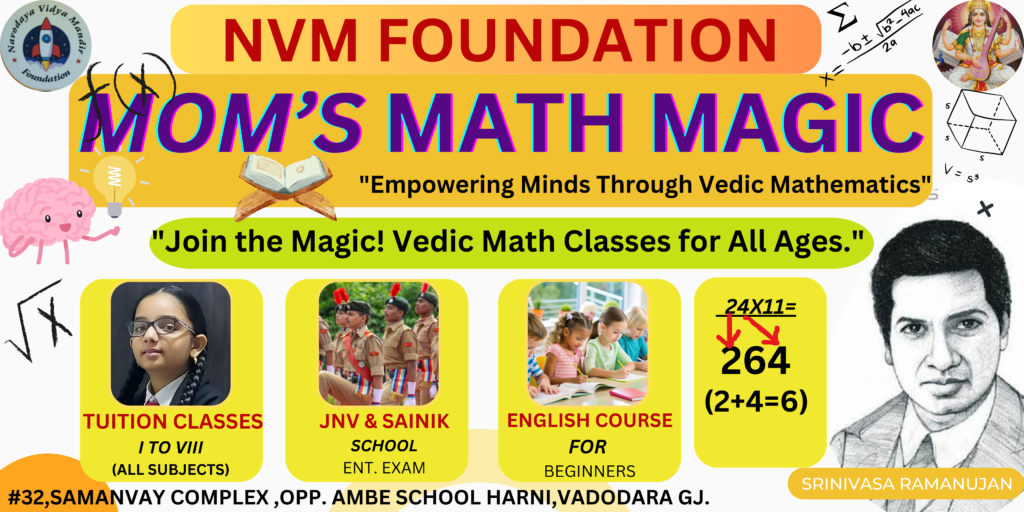

Welcome to MOMS MATH MAGIC – A Journey into Vedic Mathematics

Why This, Why Now?

Hello and welcome to my new corner on Substack! I am Bindu Thakur Verma—a passionate educator, certified Vedic Mathematics trainer, and advocate for holistic child development. Over the years, I’ve worked with children, parents, and educators, helping them unlock the magic of mathematics. Today, I am excited to extend this passion to a broader audience.

Why now? In an era where learning is evolving, I believe it’s the perfect time to blend ancient wisdom with modern teaching methods. Vedic Mathematics, with its simplicity and power, is not just about solving math problems—it’s about enhancing mental agility, confidence, and focus. Whether you’re a homemaker looking to set an inspiring example, a parent supporting your child, or a student eager to overcome math anxiety, this space is for you.

What Kind of Community Are We Building Here?

This is more than just a newsletter—it’s a vibrant community of learners, teachers, and enthusiasts. Here, we’ll explore the magic of numbers, share teaching strategies, and inspire each other.

My goal is to make math accessible and enjoyable for everyone. This will be a space where homemakers can become role models for their children, students can conquer their math fears, and educators can find innovative teaching tools. Together, we’ll learn, grow, and create a supportive ecosystem for mathematical excellence.

What to Expect?

Here’s a quick snapshot of what you’ll find:

- Weekly Posts: Expect two posts every week—on Mondays and Thursdays.

- Engaging Lessons: Simplified Vedic Math techniques to solve problems faster and with ease.

- Inspiration: Stories of success and overcoming challenges in learning and teaching.

- Practical Applications: Tips for integrating Vedic Math into daily life, whether you’re teaching your child or learning for personal growth.

- Resources: Downloadable worksheets, practice problems, and exclusive teaching material.

Indian Science Transforming India

1.DEFENCE TECHNOLOGY

a) The Indian Light Tank (ILT), also known as Zorawar, has successfully completed firing trials at an altitude of over 4,200m.

- It was jointly developed by the Defence Research and Development Organisation (DRDO) and Larsen & Toubro (L&T) with contributions from various Micro, Small, and Medium Enterprises for high-altitude warfare and rapid deployment.

- Key Features:

- High-Altitude Performance: It successfully fired multiple rounds with precision at varying ranges and demonstrated exceptional mobility and reliability in the challenging terrain of Ladakh.

- Airlift Capability: It was successfully airlifted by the Indian Air Force, enabling rapid deployment to remote and inaccessible areas.

- Significance: It strengthens India’s mountain warfare capabilities with indigenous innovation, offering air transportability, high-angle firing, and limited artillery roles for enhanced mobility.

b) What are Dual Use Goods/Technologies?

- About Dual Use Goods:

- Dual-use goods are items that can be used both for civilian and military applications.

- Examples of dual-use goods and technology include global positioning satellites, missiles, nuclear technology, chemical and biological tools, night vision technology, thermal imaging, drones etc.

- Examples of Dual-Use Technologies:

- Hypersonics: Hypersonic systems fly at or above 5 times the speed of sound. They could be used for low-cost satellite launches and as a backup if satellites fail.

- Integrated Network Systems-of-Systems: It allows governments to better integrate many diverse mission systems and provide fully networked command, control, and communication that is capable, resilient, and secure.

- Microelectronics: Every military and commercial system relies on microelectronics for creation of personal computers, cell phones and defence equipment.

- Export Controls Provisions Related to Dual Use Goods/Technologies: Their trade and export are regulated by multilateral dual-use export control regimes.

- Wassenaar Arrangement (WA): It aims to contribute to regional and international security and stability, by promoting transparency and greater responsibility in transfers of conventional arms and dual-use goods and technologies.

- India was inducted to the Wassenaar Arrangement in 2017 as the 42nd member.

- Nuclear Suppliers Group (NSG): NSG is a group of nuclear fuel/technologies supplier countries that seeks to contribute to the non-proliferation of nuclear weapons.

- India is not a member of the NSG as India’s non-signatory status to the Nuclear Non-Proliferation Treaty.

- Although India is not a member of the NSG, it voluntarily practices non-proliferation of nuclear technologies

- India is not a member of the NSG as India’s non-signatory status to the Nuclear Non-Proliferation Treaty.

- Australia Group: It is an informal forum of countries which, through the harmonisation of export controls, seeks to ensure that exports do not contribute to the development of chemical or biological weapons.

- India joined the Australia Group in 2018.

- Missile Technology Control Regime (MTCR): MTCR is an informal and voluntary partnership among 35 countries to prevent the proliferation of missile and unmanned aerial vehicle technology capable of carrying greater than 500 kg payload for more than 300 km.

- India was inducted into the Missile Technology Control Regime in 2016.

- CWC and BWC: India is a signatory to international conventions on disarmament and non-proliferation, viz. the Chemical Weapons Convention (CWC) and Biological and Toxin Weapons Convention (BWC).

- UN Security Council Resolution 1540: The United Nations requires member countries to control the export of goods that could cause harm to humanity and the pursuit of global peace.

- Wassenaar Arrangement (WA): It aims to contribute to regional and international security and stability, by promoting transparency and greater responsibility in transfers of conventional arms and dual-use goods and technologies.

What are Key Developments in Dual-Use Defence Technology in Relation to Russia?

- Fear of Sanctions: Indian companies are at a risk of facing sanctions from the US under the Countering America’s Adversaries Through Sanctions Act (CAATSA).

- Limiting Financial Access: U.S. Treasury officials have advised Indian banks and financial institutions that doing business with Russia’s military-industrial base could risk their access to the U.S. financial system.

- India’s Position on Dual-Use Exports: The items identified by the US are not Special Chemicals, Organisms, Materials, Equipment and Technologies (SCOMET) items, which require licensing for trade.

- Dual-use goods are categorised under the SCOMET list in India.

- India’s Role and US Concerns: The US believes certain SCOMET items are entering the Russian defence manufacturing system.

- India’s exports to Russia increased by 40% in 2023, surpassing USD 4 billion. Engineering goods played a major role, with exports nearly doubling from USD 680 million in 2022 to USD 1.32 billion in 2023.

- China’s Role and US Concerns: The US said that China is the top supplier of machine tools, microelectronics, and nitrocellulose, which are critical for manufacturing munitions and rocket propellants.

- The US has blacklisted over 300 companies, citing China as the top supplier of critical dual-use items to Russia.

- Iran has supplied Russia with munitions, artillery shells, and drones.

Note:

- Russia’s Increased Defense Spending: Russia’s military spending grew by 24% in 2023 to an estimated USD 109 billion, as per the Stockholm International Peace Research Institute (SIPRI).

- As per the World Bank, economic activity in Russia was influenced by a significant increase in military-related activity in 2023.

What is India’s Strategic Trade Control System?

- About: Strategic Trade Controls are laws and regulations on managing the flow of dual-use goods, services and technologies across national borders.

- Important Legislations Include

- These laws and regulations primarily focus on controlling the export of such items to balance the country’s commercial and security considerations.

- SCOMET List: India regulates the exports of dual-use items, nuclear-related items, and military items, including software and technology under the SCOMET list.

- The SCOMET list is our National Export Control List of dual-use items, munitions and nuclear-related items, including software and technology

Conclusion

Balancing the export control of dual-use goods with national interests is crucial for India. While it’s essential to comply with international regulations and avoid sanctions, especially in sensitive geopolitical contexts like those involving Russia, India must also protect its economic interests and maintain strategic autonomy. Strengthening oversight and industry awareness ensures that export policies align with international standards, fostering both innovation and national security.

2. India's Semiconductor Sector

The global semiconductor industry stands at a critical geopolitical crossroads, with the United States and India forging strategic partnerships to challenge China’s technological dominance. Through initiatives like iCET and the CHIPS, both nations are investing billions to develop robust semiconductor ecosystems, focusing on critical technologies, talent development, and supply chain resilience. India’s semiconductor mission represents a transformative opportunity to indigenize electronic manufacturing, overcome talent shortages, and emerge as a trusted global partner in high-tech innovation.

What is the Current Status of India’s Semiconductor Sector?

- Market Size:

- In 2022, the Indian semiconductor market was valued at $26.3 billion and is projected to grow at a CAGR of 26.3% to reach $271.9 billion by 2032.

- Import-Export Trends:

- Semiconductor imports significantly outpace exports; however, exports have grown from $0.21 billion (2017) to $0.52 billion (2022).

- The pandemic disrupted global trade, but a strong recovery in 2021 reflected India’s push towards establishing itself in the semiconductor value chain.

- Semiconductor imports significantly outpace exports; however, exports have grown from $0.21 billion (2017) to $0.52 billion (2022).

- Government Initiatives:

- India Semiconductor Mission (ISM): Aims to build a robust semiconductor ecosystem with fiscal incentives of 50% project cost for fabs and display units.

- Semicon India Programme (2021): Allocated ₹76,000 crore ($9.2 billion) to accelerate manufacturing and R&D.

- International MoUs: Partnerships with the European Commission and Japan to strengthen supply chains and ecosystem collaboration

Why Investing in Semiconductors is Crucial for India?

- Strategic Importance in Geopolitics: India’s geopolitical positioning and its aspirations for self-reliance make domestic semiconductor production crucial.

- For instance, the US-China tech war highlights the need for semiconductor independence.

- According to WSTS, the global semiconductor market is expected to grow to $1 trillion by 2030, and India’s semiconductor consumption is projected to exceed $100 billion by 2026, driven by the electronics and automotive sectors.

- Boost to Domestic Manufacturing under Atma Nirbhar Bharat: Semiconductors are the backbone of electronics manufacturing, a sector targeted by the Indian government under the “Make in India” and “Atma Nirbhar Bharat” initiatives.

- India aims to achieve a 10% share in the global semiconductor market by 2030.

- Local production can reduce import dependency, which currently costs India $24 billion annually on semiconductor imports

- The Semiconductor Mission, with a $10 billion outlay for manufacturing incentives, aims to establish India as a global hub for chip production, supporting industries like mobile manufacturing and 5G.

- Tata Electronics has completed the Definitive Agreement with Powerchip Semiconductor Manufacturing Corporation (PSMC) of Taiwan to launch India’s first AI-enabled semiconductor Fab in Gujarat.

- Economic Growth and Job Creation: Investing in semiconductor manufacturing can significantly boost India’s GDP and create millions of jobs across sectors.

- With plants like Vedanta-Foxconn planning to set up fabs in India, these projects are expected to generate 1 lakh direct jobs in the coming years.

- A robust semiconductor ecosystem can boost India’s startup ecosystem, particularly in hardware development. MSMEs, which contribute 30% to India’s GDP, can benefit from affordable chips for consumer electronics, boosting their competitiveness.

- For example, startups like Saankhya Labs are already innovating in the semiconductor space, showcasing India’s potential for indigenous chip design.

- Ensuring Supply Chain Resilience: The global chip shortage during the Covid-19 pandemic exposed vulnerabilities in India’s electronics and automotive sectors.

- By investing in domestic semiconductor production, India can shield its industries from external disruptions.

- For example, the automotive industry lost $110 billion globally in 2021 due to chip shortages, with Indian carmakers facing delayed production cycles.

- Strengthening Technological Sovereignty: Semiconductors are essential for technological innovation in AI, IoT, and quantum computing, all critical for maintaining technological sovereignty.

- Countries like the US and EU are heavily investing in chip production to reduce reliance on Chinese supply chains.

- India has launched the Digital India RISC-V program and partnerships with entities like Micron Technology, which has committed to a $2.75 billion facility in Gujarat.

- Promoting Green Technology and Renewable Energy: Semiconductors are key components in green technologies like solar panels, electric vehicles (EVs), and smart grids.

- Domestic semiconductor production can accelerate India’s renewable energy goals.

- For instance, India aims to achieve 500 GW of non-fossil fuel capacity by 2030, and chips are essential for solar inverters and EV batteries.

- The number of power semiconductors used in the global renewable energy markets is expected to grow with a compound annual growth rate (CAGR) of 8% to 10% from now to 2027.

- Enhancing National Security and Cybersecurity: Semiconductors are critical for advanced defense technologies, including missile systems, drones, and secure communication networks.

- Dependence on foreign chips poses risks of espionage and cyber vulnerabilities. India has launched DRDO-led initiatives to develop indigenous chips for strategic sectors, ensuring self-reliance in defense electronics.

- DRDO has recently commissioned a Bangalore-based firm to indigenously develop a receiver chip to acquire and disseminate Indian time for Navigation.

What are the Key Issues Hindering the Progress of India’s Semiconductor Sector?

- High Capital Costs and Limited Financial Backing: Semiconductor manufacturing requires massive capital investments, with fabs costing upwards of $10 billion each, creating significant barriers for India.

- For instance, Micron Technology’s facility in Gujarat received $2.75 billion in funding but requires consistent financial commitment over the next decade to sustain operations.

- Globally, countries like the US have allocated $53 billion under the CHIPS Act, dwarfing India’s budget.

- Lack of Skilled Workforce: Semiconductor fabrication demands highly specialized expertise in areas like nanotechnology, material science, and process engineering, which India currently lacks at scale.

- While India has a strong semiconductor design workforce (20% of global share), fabrication and packaging talent remains minimal.

- Also, the semiconductor industry faces a potential skill gap of 250,000 to 300,000 professionals by 2027, that is a cause of concern.

- Weak Infrastructure and High Energy Demand: Semiconductor fabs require advanced infrastructure, including uninterrupted power, water, and cleanroom environments, which are limited in India.

- A single fab can consume as much electricity annually as a small city and up to 10 million gallons of ultrapure water daily.

- For example, the Vedanta-Foxconn project faced delays due to inadequate water and power supply chains.

- In contrast, Taiwan provides renewable energy support to its semiconductor hubs, ensuring operational efficiency.

- Insufficient R&D Ecosystem: India’s semiconductor ambitions are hindered by the lack of a robust R&D ecosystem to develop indigenous chip technology.

- Most of India’s semiconductor capabilities are focused on chip design, leaving manufacturing and material research reliant on imports.

- According to a McKinsey report (2023), India invests only 0.65% of its GDP in R&D compared to South Korea’s 4.8%.

- The absence of foundational research partnerships and university-industry collaboration further slows innovation.

- Geopolitical Dependencies on Imports: India is heavily dependent on imports for semiconductor equipment and raw materials like silicon wafers, making its supply chain vulnerable to global disruptions.

- Over 75% of the world’s semiconductor production is concentrated in East Asia, with China being a dominant supplier of raw materials.

- The ongoing US-China tech war exposed these vulnerabilities, with India’s electronics manufacturing suffering delays and increased costs.

- In 2022, India imported semiconductors worth $24 billion, highlighting its import dependence.

- Long Gestation Period and Low ROI: The semiconductor industry operates on a long gestation cycle, with fabs taking 4–5 years to become operational and even longer to achieve profitability.

- Investors often hesitate due to the high initial costs and slow returns. For instance, the US-based Intel took nearly a decade to recover its fab investments, even with government support.

- In India, startups and MSMEs find it particularly challenging to invest in such long-term projects without sustained subsidies and market guarantees..

- Limited Role of Private Sector in Fabrication: While India’s private sector is strong in software and design, its role in semiconductor fabrication is minimal due to high costs and technical barriers.

- Most semiconductor initiatives are government-led, with limited private investment in fab infrastructure.

- For instance, companies like Infosys and Wipro dominate chip design but have no presence in fabrication.

- In contrast, Taiwan’s semiconductor success stems from private giants like TSMC, which have driven the industry with government support.

- Fragmented Approach Across States: India’s federal structure leads to fragmented policies, with states competing rather than collaborating on semiconductor investments. States like Gujarat, Karnataka, and Tamil Nadu offer competing incentives, overshadowing other states and hindering unified semiconductor hubs.

- In contrast, China coordinates semiconductor development at a national level, ensuring seamless integration of resources across regions.

- Low Focus on Advanced Nodes: India’s semiconductor ambitions currently focus on legacy and mature nodes (28nm and above), which are insufficient for advanced technologies like AI, quantum computing, and 5G.

- Global demand is shifting toward advanced nodes like 5nm and 3nm, with TSMC and Samsung leading this market.

- Without investments in advanced node capabilities, India risks being limited to low-value segments of the semiconductor market.

What Measures can India Adopt to Strengthen its Semiconductor Ecosystem?

- Enhancing Financial Incentives and De-risking Investments: India should provide enhanced financial incentives, such as tax breaks, subsidies, and low-interest loans, to attract semiconductor investors while ensuring long-term viability.

- A dedicated Semiconductor Development Fund could reduce risks associated with the long gestation period of fabs.

- The US CHIPS Act ($52 billion) is a model India can emulate to offer a similar level of financial assurance.

- Building a Skilled Workforce through Specialized Training: Developing a skilled workforce for semiconductor design and fabrication is crucial. India can establish specialized training centers in collaboration with global leaders like Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung.

- Programs like the India Semiconductor Mission’s aim to train 85,000 professionals should be expanded and linked to industry needs.

- Offering scholarships in nanotechnology and VLSI design through IITs and NITs could address immediate skill gaps.

- Fostering Public-Private Partnerships: Strengthening PPPs can drive innovation and scale in India’s semiconductor sector.

- Private players can focus on chip design and innovation while the government handles large-scale fabrication facilities.

- For instance, a model similar to TSMC’s public-private synergy could be implemented to streamline investments and operations.

- Collaborations like Vedanta-Foxconn show promise but need clearer frameworks to avoid delays in execution.

- Investing in Semiconductor R&D Ecosystem: India must establish semiconductor R&D centers to foster innovation in materials, designs, and advanced nodes.

- Government grants and private funding should be allocated to create semiconductor-focused research hubs in collaboration with academic institutions.

- For example, the Digital India RISC-V (DIR-V) program can serve as a platform for designing India’s indigenous chips.

- Improving Infrastructure for Fabs: India must address infrastructure challenges such as uninterrupted power supply, ultra-pure water availability, and cleanroom environments for fabs.

- Industrial clusters should be developed near semiconductor hubs, with states like Gujarat and Karnataka leading the way.

- Fast-tracking renewable energy projects for fabs, akin to TSMC’s solar-powered facilities, would reduce operational costs.

- Government-supported infrastructure projects, such as dedicated semiconductor parks, should be prioritized.

- Strengthening the Supply Chain for Raw Materials: India should develop an indigenous supply chain for essential semiconductor materials like silicon wafers and rare earth elements.

- Establishing tie-ups with countries like Australia and Japan for rare earth sourcing would reduce dependency on China.

- Investing in local production facilities for silicon wafers and chemicals would strengthen resilience.

- For example, India’s recent MoU with IEA on critical minerals could focus especially on semiconductor raw materials.

- Promoting Advanced Node Development: India should invest in developing advanced nodes (below 10nm) to remain competitive in cutting-edge technologies like AI, quantum computing, and 5G.

- Establishing advanced research labs dedicated to smaller nodes, supported by government funding, will ensure India’s entry into high-value markets.

- Creating a Semiconductor Export Hub: India should position itself as an export hub for semiconductors by leveraging its strategic location and cost-effective labor.

- Incentives should be provided to attract global companies to establish chip packaging, testing, and design facilities.

- A free trade agreement with technology-importing countries could ensure preferential access to markets. .

- Simplifying Regulatory Approvals and Bureaucratic Processes: India needs to streamline its regulatory framework to attract global semiconductor investments. Setting up a single-window clearance system for semiconductor projects would reduce delays and improve investor confidence.

- For example, the Vedanta-Foxconn project faced delays due to bureaucratic inefficiencies; such issues must be resolved through transparent processes.

- Creating National Semiconductor Task Force to harmonize state and central efforts

- Encouraging Domestic IP Development: India must encourage the development of indigenous semiconductor intellectual property (IP) by funding local startups and research institutions.

- Initiatives like the “Chip-to-Startup” program can be expanded to focus on IP creation for specific industries like automotive and IoT. Incentivizing patents through subsidies or grants can boost India’s rank in global semiconductor IP filings.

- Promoting Green and Sustainable Fabs: To address environmental concerns, India must encourage semiconductor fabs to adopt green technologies. Incentives should be provided for fabs using renewable energy and advanced water recycling methods, similar to TSMC’s approach.

- Dedicated sustainability goals for semiconductor projects would align with India’s net-zero emissions target by 2070. .

- Encouraging State and Regional Collaboration: Rather than competing for semiconductor investments, Indian states should collaborate to create a unified national semiconductor strategy.

- Regional clusters like the Bengaluru-Mysuru corridor or the Gujarat-Maharashtra cluster can specialize in design, packaging, and fabrication.

- Federal support through the Semiconductor Mission can harmonize state-level policies, avoiding duplication of efforts.

- Leveraging India’s Software Expertise: India can integrate its global leadership in software with semiconductor hardware development to create a comprehensive tech ecosystem.

- Combining chip design with AI and software solutions can drive demand for indigenous semiconductors.

Conclusion:

India’s semiconductor mission holds immense potential to transform the country into a global tech hub. The government’s continued support, coupled with private sector investment and technological innovation, will be crucial in realizing this ambitious goal. A successful semiconductor ecosystem will not only strengthen India’s digital economy but also elevate its strategic position in the global tech landscape.

Find the top online schools in Wisconsin, with detailed rankings and reviews.

Register for a respected online school in Wisconsin, and start your educational journey today.

Study online from anywhere in Wisconsin, with customizable schedules and individualized assistance.

Improve your professional options with an online certificate in Wisconsin, from recognized online institutions in Wisconsin.

Achieve your academic goals with an online school in Wisconsin, designed to meet your requirements and timetable.

Engage with classmates in online discussions in Wisconsin, and build a strong network for your future.

Benefit from online libraries and databases for your studies in Wisconsin, to excel in your online education and succeed in your online school.

Online Schools in Wisconsin onlineschoolwi6.com .

Find the best online schools in Missouri, with affordable tuition rates.

Enroll in an accredited online school in Missouri, that offers personalized support.

Considering online schools in Missouri for your next academic venture?, Browse through our top picks.

Achieve your academic goals from the comfort of your home in Missouri, with engaging course materials.

How can online schools in Missouri enhance your learning experience?, Find out more here.

Engage with like-minded individuals at an online school in Missouri, and expand your network.

Explore the online learning resources in Missouri, to deepen your knowledge.

Online Schools in Missouri https://www.onlineschoolmo6.com .